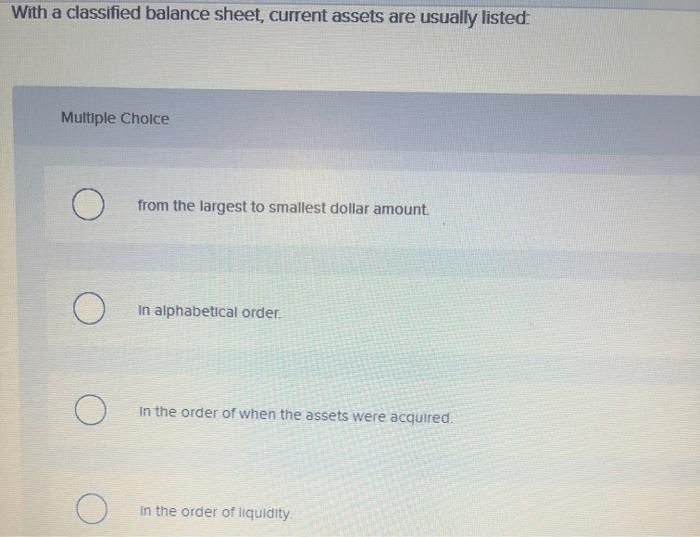

On a classified balance sheet current assets are customarily listed – On a classified balance sheet, current assets are customarily listed first, setting the stage for a comprehensive understanding of a company’s financial health. This practice provides a clear and organized presentation of a company’s short-term assets, offering valuable insights into its liquidity and solvency.

The classification of assets and liabilities on a balance sheet serves a critical purpose in financial analysis. By segregating current assets from non-current assets, analysts and investors can quickly assess a company’s ability to meet its short-term obligations and gauge its overall financial stability.

1. Definition and Overview: On A Classified Balance Sheet Current Assets Are Customarily Listed

A classified balance sheet is a financial statement that categorizes assets and liabilities into different groups based on their liquidity and maturity. This classification helps provide a more detailed and organized view of a company’s financial position.

The purpose of classifying assets and liabilities on a balance sheet is to provide users with a clear understanding of the company’s liquidity, solvency, and financial flexibility. By grouping assets and liabilities into different categories, users can easily assess the company’s ability to meet its short-term and long-term obligations.

2. Current Assets on a Classified Balance Sheet

Current assets are assets that are expected to be converted into cash within one year or one operating cycle, whichever is longer. They are typically listed first on a classified balance sheet because they are the most liquid assets and are used to meet short-term obligations.

Characteristics of current assets include:

- Easily convertible into cash

- Used to meet short-term obligations

- Include cash, accounts receivable, inventory, and marketable securities

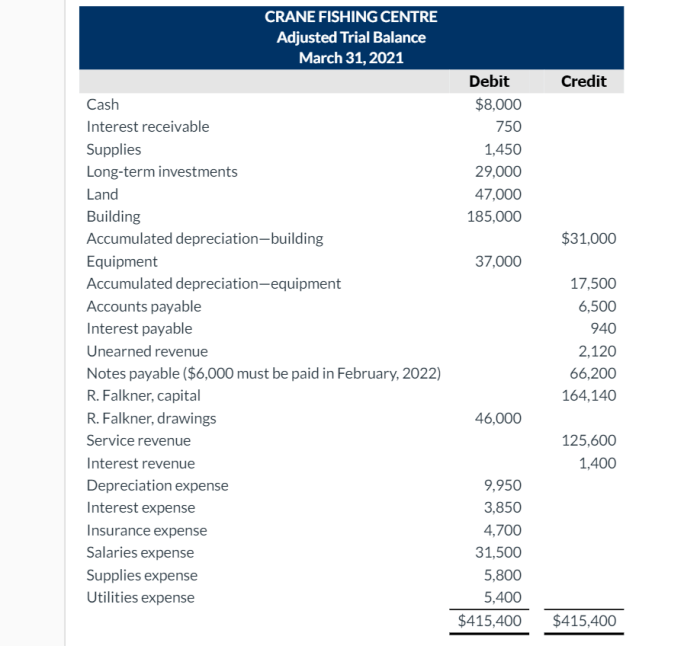

3. Examples of Current Assets

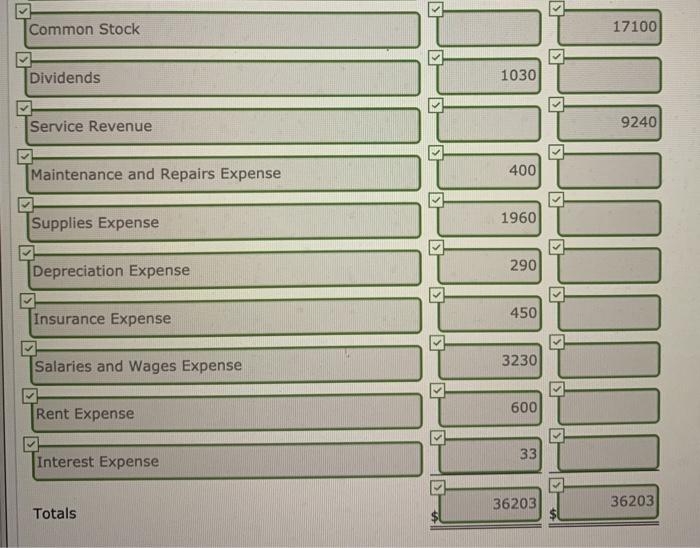

| Type of Current Asset | Definition | Examples |

|---|---|---|

| Cash | Money on hand and in banks | Cash on hand, checking accounts, savings accounts |

| Accounts Receivable | Amounts owed to the company by customers for goods or services sold on credit | Invoices, trade receivables |

| Inventory | Goods held for sale or use in the production of goods or services | Raw materials, work in progress, finished goods |

| Marketable Securities | Short-term investments that can be easily converted into cash | Stocks, bonds, money market instruments |

4. Importance of Classifying Current Assets

Classifying current assets is important for financial analysis because it helps users assess a company’s liquidity and short-term solvency. By analyzing the composition and changes in current assets, users can gain insights into the company’s ability to meet its short-term obligations and its overall financial health.

Investors and creditors use the classification of current assets to make informed decisions about investing in or lending to a company. A company with a high proportion of current assets relative to its current liabilities is generally considered to be more liquid and less risky.

5. Other Classifications on a Balance Sheet

In addition to current assets, a classified balance sheet also includes other asset and liability classifications such as non-current assets, current liabilities, and non-current liabilities.

- Non-current assetsare assets that are not expected to be converted into cash within one year or one operating cycle, whichever is longer.

- Current liabilitiesare obligations that are due within one year or one operating cycle, whichever is longer.

- Non-current liabilitiesare obligations that are not due within one year or one operating cycle, whichever is longer.

These classifications provide a comprehensive view of a company’s financial position and help users understand its long-term solvency and financial flexibility.

Common Queries

What are the typical current assets found on a classified balance sheet?

Typical current assets include cash and cash equivalents, accounts receivable, inventory, and marketable securities.

Why are current assets listed first on a balance sheet?

Current assets are listed first because they are considered the most liquid assets and are expected to be converted into cash within one year.

How do investors and creditors use the classification of current assets?

Investors and creditors use the classification of current assets to assess a company’s liquidity and short-term solvency. This information helps them make informed decisions about investing in or lending to the company.